Wheaton Precious Metals: Strong Momentum for Shares as Strategic Goldmine Deals Paint a Shiny Outlook

20.12.2025 - 14:29:04Wheaton Precious Metals has become one of the clear outperformers in the precious metals space, with its shares up an impressive 11% over the last three months. The corporation’s price has risen from a local low of approximately 148 CAD in September to stand near 165 CAD just before year-end. In a sector known for volatility, that’s not just a technical rebound—it’s the result of a stream of positive news and strategic moves by the company. But with gold prices swinging, is this just a pause in a much bigger rally for Wheaton Precious Metals, or is a correction looming?

Explore Wheaton Precious Metals’ current share price, chart and analysis

Digging deeper into the corporation's trajectory, several events have left their mark on the stock’s recent surge. On December 10, RBC Capital Markets created a noticeable buzz by upgrading Wheaton Precious Metals to ‘Outperform’ and raising its price target from $115 to $130 USD. The market responded with a significant uptick—investors seemed encouraged by what many see as a strong validation of Wheaton’s goldmine streaming strategy. Just days later, Berenberg also upped its target and cemented a bullish outlook, reinforcing the narrative that the corporation is well-positioned for further growth.

This optimism is built on a bedrock of both corporate fundamentals and bold moves in the M&A arena. Late November brought news that Wheaton had completed its previously announced gold stream on the Hemlo Mine—a deal worth USD 300 million. For many observers, this isn’t just another transaction. It’s a signal: Wheaton is intent on bolstering its precious metals pipeline and diversifying its sources of gold and silver revenue, a move that is often interpreted as defensive in a volatile macro environment.

Quarterly results released in early November (with Q4 2025 earnings expected in March) showed resilience in core operating metrics. The company’s net income and free cash flow remained strong, supporting ongoing dividend distributions—albeit with a cautious yield of around 0.5%. On the guidance front, Wheaton Precious Metals has signaled steady volumes and a commitment to further streaming agreements rather than speculative outright goldmine acquisitions, a strategy applauded by many sector analysts for its risk-mitigating qualities.

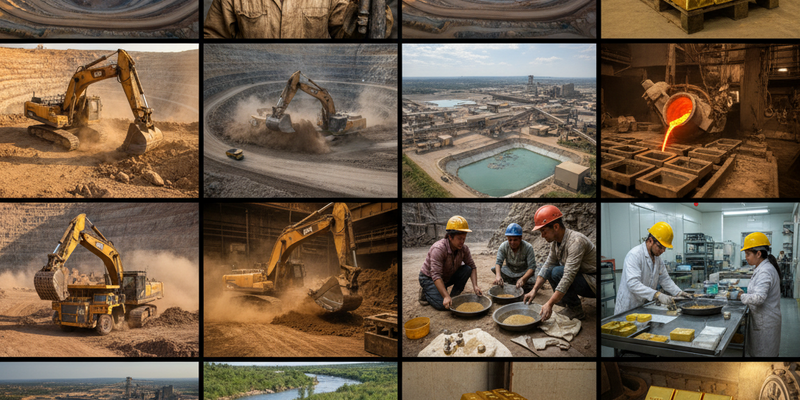

The corporation’s business model is somewhat unique: rather than operate goldmines directly, Wheaton Precious Metals negotiates strategic streaming agreements. Through roughly 35 streaming deals and several royalty contracts, Wheaton secures the right to purchase a percentage of metals production (gold, silver, palladium, platinum, and even cobalt) from partner mines at fixed prices. This offers a potentially powerful blend of growth and downside protection—if metals prices soar, Wheaton benefits from the upside; if not, its costs remain controlled. It’s a formula that’s allowed them to report robust sales, with net sales for 2025 projected at over USD 2.1 billion and net income above USD 1.3 billion.

Wheaton’s footprint stretches across major gold districts in the Americas (Brazil, Canada, Mexico), but also taps into emerging projects in Africa and Australia. Its success has drawn frequent sector comparisons, often in the same breath as giants like Newmont or Agnico Eagle. Yet what sets Wheaton Precious Metals apart is its razor-sharp focus on streaming, which insulates the corporation from direct mining risks—operational disruptions, regulatory blowback, or cost overruns tend to hit operators harder than streamers. With a lightweight corporate structure (fewer than 50 employees), its asset returns and margins are among the most admired in the goldmine business.

Strategically, 2024 and 2025 have been years of cautious yet ambitious deals. The Hemlo Mine streaming agreement stands as a highlight, but company observers expect further activity in both new market entries and add-on deals to existing streams. Long-term tailwinds include an ongoing shift among mining operators to seek up-front financing via streaming partnerships—a structural trend that plays directly into Wheaton’s hands. The major risk? Sensitivity to precious metal price fluctuations. While Wheaton’s business model smooths out some of the turbulence, sustained drops in gold or silver prices would clip its wings. Regulatory headwinds or unfavorable changes in contract terms are less frequent, but always on the radar for seasoned sector investors.

Looking ahead, many analysts—reflected by an average 12-month price target of approximately USD 138—consider Wheaton Precious Metals relatively well positioned for further outperformance, though upside potential depends on both the continued rise in gold prices and Wheaton’s ability to lock in additional lucrative streams. On the qualitative side, the company’s focus on sustainability, capital discipline, and operational transparency earns consistent praise from institutional shareholders.

So where does this leave potential investors and followers of the goldmine sector? Wheaton Precious Metals represents a corporation at the intersection of disciplined growth and strategic risk management. As gold prices continue to sway on the global stage, key dates—such as the upcoming Q4 2025 earnings in March—could serve as further catalysts. Astute market watchers may want to keep Wheaton on their radar for both price action and deal flow.

Don't miss the next move—check Wheaton Precious Metals’ latest quote and performance now